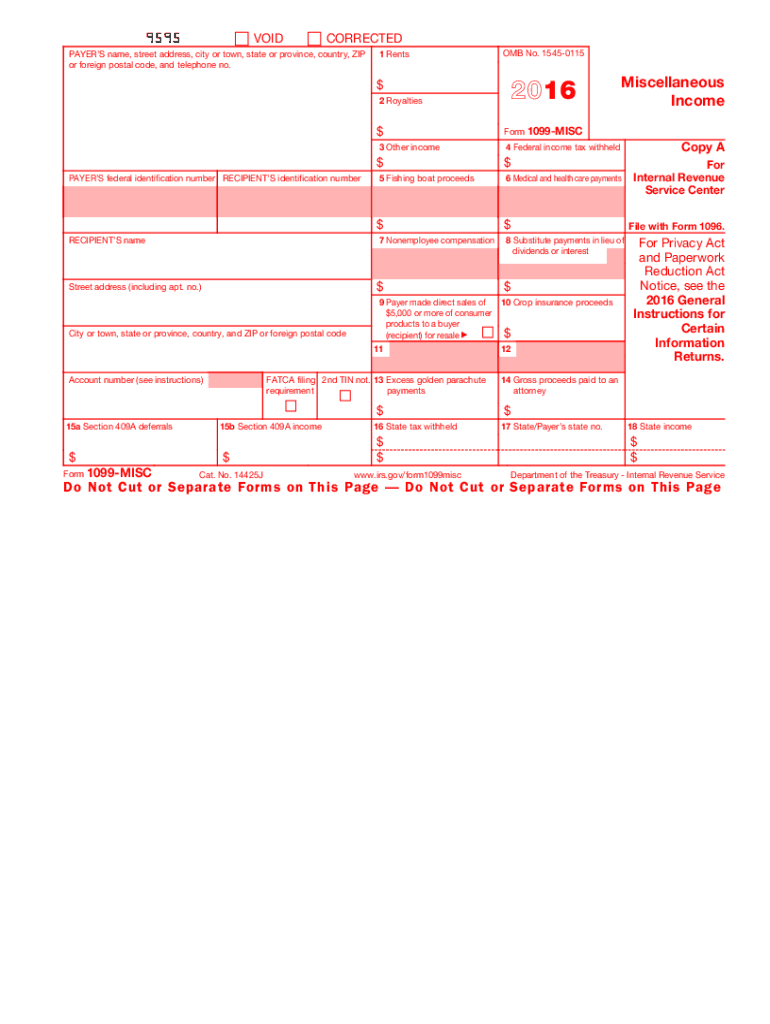

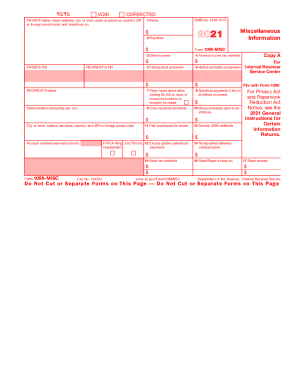

Who fills out a 1099-MISC form?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:

-

you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;

-

or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.

What is this document for?

The 1099-MISC is a report of the total amount of taxable payments the independent contractor received from a single person or a business. It is aimed to prevent the self-employed from underreporting their miscellaneous income.

Is 1099-MISC form accompanied by other forms?

While completing the fillable document, a business entity must use the name, address and Social Security or tax identification number as indicated in your W-9. The individual contractors must report their miscellaneous earnings (from 1099) on a 1040 tax return as well.

When is the form due?

The deadline for businesses to send the copy to individual contractors is January 31st of the year following the tax year being reported, while the individuals are required to submit the filled out 1099 forms to the IRS by February 28th. However, if you are using electronic filing, the due dates are later — February 28th and March 31st, respectively.

How do I create the 1099-MISC form?

The details provided on the form must include the company’s basic information along with a tax ID number and its address. The contractor on his part is required to indicate his name, identification or social security number and other personal information. To help you out with completing the document there is an instruction from the IRS on Page 5 and Page 7.

Where do I file 1099-MISC form?

1099-MISC is a multi-part document and should be received by different institutions: the IRS, state tax departments, the recipient of the income, etc. Each copy bears a note stating where to send the particular page. Therefore, having completed the form you should read carefully what the destination of all 1099-MISC copies are and make sure that all the recipients get the document on time.